All Categories

Featured

Table of Contents

These payments are built right into the acquisition cost, so there are no covert charges in the MYGA contract. That implies acquiring multiple annuities with staggered terms.

For instance, if you opened up MYGAs of 3-, 4-, 5- and 6-year terms, you would certainly have an account maturing annually after three years. At the end of the term, your money can be withdrawn or put right into a new annuity-- with luck, at a greater rate. You can likewise make use of MYGAs in ladders with fixed-indexed annuities, an approach that seeks to make the most of return while likewise shielding principal.

As you compare and comparison images used by various insurance provider, think about each of the locations detailed over when making your final choice. Understanding contract terms as well as each annuity's benefits and drawbacks will allow you to make the most effective choice for your economic situation. are immediate annuities taxable. Think meticulously concerning the term

15 Year Annuities

If passion rates have climbed, you might want to secure them in for a longer term. During this time, you can obtain all of your money back.

The firm you purchase your multi-year assured annuity through accepts pay you a fixed rate of interest on your costs quantity for your picked period. explain how annuities work. You'll get passion credited regularly, and at the end of the term, you either can restore your annuity at an upgraded price, leave the cash at a taken care of account price, choose a negotiation option, or withdraw your funds

Considering that a MYGA uses a fixed rates of interest that's guaranteed for the contract's term, it can give you with a predictable return. Defense from market volatility. With prices that are established by agreement for a certain number of years, MYGAs aren't based on market fluctuations like other investments. Tax-deferred growth.

Questions To Ask When Buying An Annuity

Restricted liquidity. Annuities commonly have fines for very early withdrawal or abandonment, which can limit your ability to access your money without costs. Lower returns than various other financial investments. MYGAs may have reduced returns than supplies or common funds, which might have greater returns over the lengthy term. Costs and expenses. Annuities typically have surrender costs and management expenses.

MVA is an adjustmenteither positive or negativeto the gathered value if you make a partial abandonment over the cost-free quantity or fully surrender your agreement during the abandonment fee period. Inflation threat. Since MYGAs supply a fixed rate of return, they may not maintain rate with inflation with time. Not insured by FDIC.

Annuities Are Purchased To

It's essential to vet the toughness and stability of the business you pick. Consider records from A.M. Best, Fitch, Moody's or Standard & Poor's. MYGA rates can transform often based on the economic climate, however they're generally more than what you would certainly make on a savings account. The 4 kinds of annuities: Which is right for you? Required a refresher course on the 4 fundamental kinds of annuities? Find out much more exactly how annuities can ensure a revenue in retirement that you can't outlive.

If your MYGA has market price modification stipulation and you make a withdrawal before the term mores than, the business can change the MYGA's abandonment value based on modifications in interest prices. If prices have actually raised considering that you purchased the annuity, your abandonment worth may decrease to represent the greater rate of interest rate atmosphere.

However, annuities with an ROP stipulation generally have lower surefire rate of interest to offset the business's possible threat of needing to return the premium. Not all MYGAs have an MVA or an ROP. Conditions depend on the business and the contract. At the end of the MYGA duration you've selected, you have 3 alternatives: If having actually an ensured rates of interest for a set variety of years still straightens with your monetary approach, you simply can restore for an additional MYGA term, either the very same or a different one (if offered).

Retirement Annuity Withdrawal

With some MYGAs, if you're not exactly sure what to do with the cash at the term's end, you do not need to do anything. The gathered value of your MYGA will move right into a repaired account with a renewable one-year rates of interest established by the firm. You can leave it there until you choose your following step.

While both offer ensured rates of return, MYGAs frequently offer a higher rate of interest rate than CDs - fixed term annuities. MYGAs expand tax deferred while CDs are exhausted as earnings yearly.

This decreases the possibility for CDs to profit from long-lasting compound rate of interest. Both MYGAs and CDs commonly have early withdrawal fines that may affect temporary liquidity. With MYGAs, surrender costs may use, relying on the sort of MYGA you select. So, you might not only weary, but also principalthe money you initially added to the MYGA.

Are Annuities Considered Liquid Assets

This suggests you may lose passion but not the major amount contributed to the CD.Their conventional nature typically charms extra to individuals who are approaching or currently in retirement. They could not be best for every person. A may be ideal for you if you wish to: Make the most of a guaranteed price and secure it in for a duration of time.

Take advantage of tax-deferred revenues growth (are pensions annuities). Have the choice to pick a negotiation option for an assured stream of earnings that can last as long as you live. As with any sort of savings car, it is essential to meticulously assess the conditions of the product and speak with to establish if it's a smart choice for accomplishing your private demands and goals

Agl Annuity

1All assurances consisting of the survivor benefit settlements are dependent upon the claims paying ability of the issuing firm and do not use to the investment efficiency of the underlying funds in the variable annuity. Properties in the hidden funds are subject to market threats and may rise and fall in value. Variable annuities and their underlying variable financial investment alternatives are offered by program only.

This and various other information are included in the program or summary prospectus, if offered, which might be gotten from your financial investment specialist. Please read it prior to you spend or send money. 2 Rankings are subject to transform and do not use to the hidden investment alternatives of variable items. 3 Current tax obligation legislation is subject to analysis and legislative change.

Modified Guaranteed Annuity

Entities or individuals dispersing this information are not authorized to offer tax or legal guidance. People are motivated to seek specific suggestions from their personal tax or legal counsel. 4 , Just How Much Do Annuities Pay? - annuity vs retirement 2023This material is meant for general public use. By offering this content, The Guardian Life Insurance Policy Firm of America, The Guardian Insurance Coverage & Annuity Company, Inc .

Table of Contents

Latest Posts

Highlighting Variable Vs Fixed Annuity Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Fixed Vs Variable An

Exploring Annuities Variable Vs Fixed Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity Breaking Down the Basics of Investment Plans Advantages and Disadvantages of

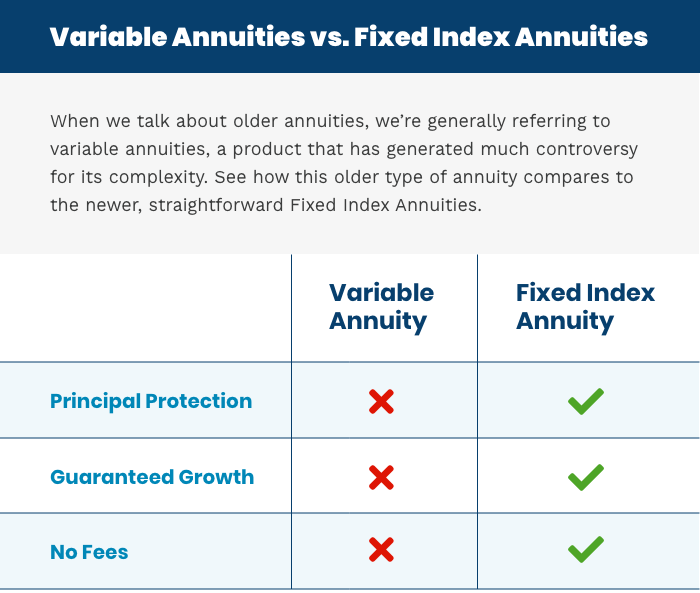

Decoding How Investment Plans Work A Closer Look at Variable Annuity Vs Fixed Indexed Annuity Defining Tax Benefits Of Fixed Vs Variable Annuities Features of Fixed Index Annuity Vs Variable Annuity W

More

Latest Posts